The Online Banking and Mortgage Application websites may have a different privacy policy, security level, and terms and conditions than those offered on Toyotabank.com.

Tracy Curry

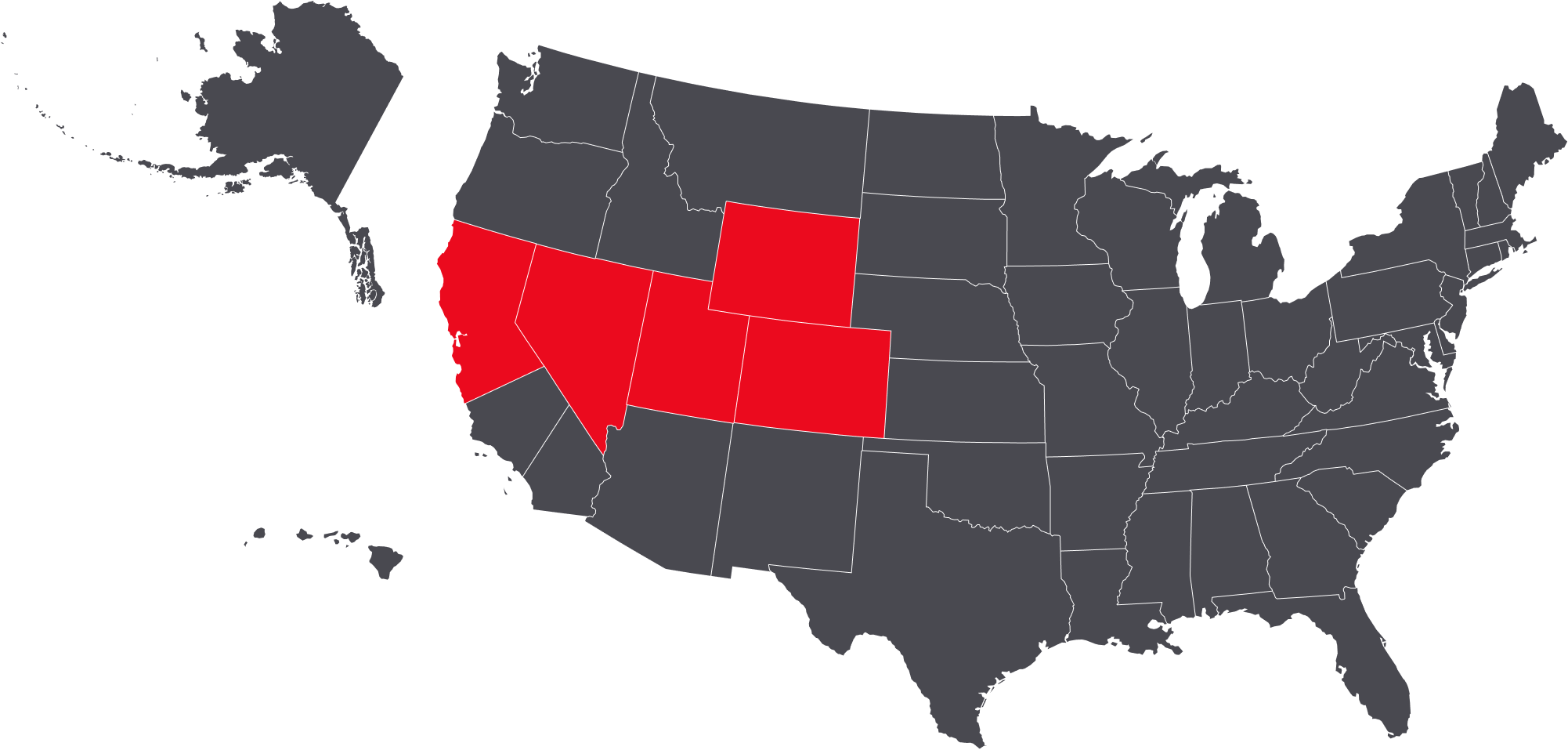

Tracy Curry is a Regional Product Manager who has been serving Toyota for 16 years. She offers services related to client portfolio management, individual banking solutions, and mortgage lending.

She loves representing Toyota because she can confidently offer prestige, style, and reliability to her clients. Tracy works hard to give accurate and dependable service as she helps her clients grow a robust business portfolio. With an excellent attention to detail, genuine connection to people, and an extensive knowledge of financial services, Tracy is proud to help folks reach their goals.

Prior to her current role, Tracy studied Business Administration. Additionally, she served as a Banking Center Manager with Bank of America.

In her free time, Tracy is trying to learn French, making plans to travel the world, and catching a few games. Lately, she’s loving the Las Vegas Raiders.

Request A Meeting

HERE'S WHAT WE OFFER

* All Account Types: Minimum balance to earn interest: $0.01. Interest Rates and APYs are accurate as of the effective date of the Deposit Rate Sheet. See our APYs, Fees, Terms and Disclosures here. Fees could reduce earnings on these accounts. APYs and other fees and terms stated here may be subject to change without notice. Business Accounts are only available to Dealer Banking Customers. FDIC insurance available to legal limits. Products offered by Toyota Financial Savings Bank. Deposits in savings accounts, money market accounts, and Certificates of Deposit (CDs) are insured up to $250,000 per depositor, per insured bank, for each account ownership category under the FDIC's general deposit insurance rules.

1. Money Market and Savings Accounts: Minimum opening deposit for a Personal Money Market and a Personal Savings Account is $500.00. Minimum opening deposit for a Business Money Market and a Business Savings Account is $2,500.00. Interest Rates and APYs on Money Market and Savings accounts may change after the account is open.

* All Account Types: Minimum balance to earn interest: $0.01. Interest Rates and APYs are accurate as of the effective date of the Deposit Rate Sheet. See our APYs, Fees, Terms and Disclosures here. Fees could reduce earnings on these accounts. APYs and other fees and terms stated here may be subject to change without notice. Business Accounts are only available to Dealer Banking Customers. FDIC insurance available to legal limits. Products offered by Toyota Financial Savings Bank. Deposits in savings accounts, money market accounts, and Certificates of Deposit (CDs) are insured up to $250,000 per depositor, per insured bank, for each account ownership category under the FDIC's general deposit insurance rules.

2. Certificates of Deposit: Minimum opening deposit for a Certificate of Deposit account is $1.00. Interest Rates and APYs for Certificates of Deposits are fixed and are guaranteed for the length of the initial term. All Certificates of Deposits may be subject to an early withdrawal penalty. All Certificates of Deposit are automatically renewable.

* All Account Types: Minimum balance to earn interest: $0.01. Interest Rates and APYs are accurate as of the effective date of the Deposit Rate Sheet. See our APYs, Fees, Terms and Disclosures here. Fees could reduce earnings on these accounts. APYs and other fees and terms stated here may be subject to change without notice. Business Accounts are only available to Dealer Banking Customers. FDIC insurance available to legal limits. Products offered by Toyota Financial Savings Bank. Deposits in savings accounts, money market accounts, and Certificates of Deposit (CDs) are insured up to $250,000 per depositor, per insured bank, for each account ownership category under the FDIC's general deposit insurance rules.

3. FDIC INSURANCE: Funds in your account(s) with us are insured by the Federal Deposit Insurance Corporation (FDIC) and backed by the full faith and credit of the United States government. Deposits in savings accounts, money market accounts, and Certificates of Deposit (CDs) are insured up to $250,000 per depositor, per insured bank, for each account ownership category under the FDIC's general deposit insurance rules. FDIC insurance available to legal limits

* All Account Types: Minimum balance to earn interest: $0.01. Interest Rates and APYs are accurate as of the Deposit Rate Sheet. See our APYs, Fees, Terms and Disclosure here. Fees could reduce earnings on these accounts. APYs and other fees and terms stated here may be subject to change without notice. Business Accounts are only available to Dealer Banking Customers. FDIC insurance available in legal limits. Products offered by Toyota Financial Savings Bank.

4. Upon completion of approved application and subject to eligibility requirements.