The Online Banking and Mortgage Application websites may have a different privacy policy, security level, and terms and conditions than those offered on Toyotabank.com.

Doug Cole

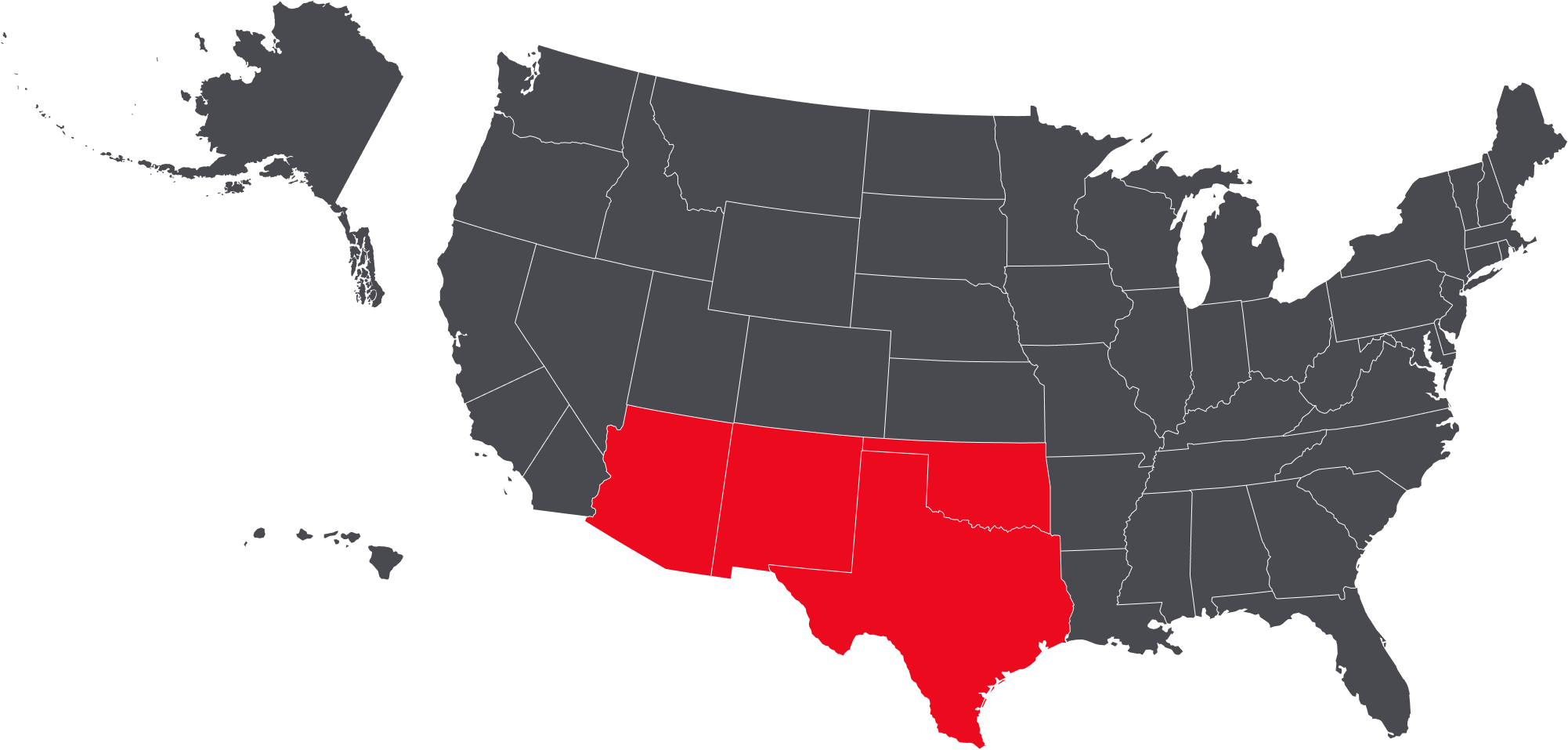

Doug Cole is a Regional Bank Product Manager, serving Toyota for nearly a decade. As a personal banker, Doug provides reliable and accurate service to the dealer leadership team with banking deposit products.

Doug prides himself on his analytical skills and open communication style. His clients rely upon him for his expertise and efficiency, so he works hard to deliver on his promises. To him, that means providing the most accurate numbers while taking time to ensure his clients feel secure and confident in their decisions.

As a personal banker, Doug finds inspiration from Toyota’s philosophy to always strive for the next level. It’s Toyota’s commitment to all kinds of people — from families to travel buffs — that keeps him so enthusiastic about the brand. It’s about both belonging and the freedom to go places.

Before joining Toyota, Doug worked closely with some of the largest dealerships across the US. Because of his dedicated work ethic, he successfully increased annual growth and credit card adoption for these dealerships.

His love for cars extends beyond his job. His current dream car? A Lexus LC500.

Request A Meeting

HERE'S WHAT WE OFFER

* All Account Types: Minimum balance to earn interest: $0.01. Interest Rates and APYs are accurate as of the effective date of the Deposit Rate Sheet. See our APYs, Fees, Terms and Disclosures here. Fees could reduce earnings on these accounts. APYs and other fees and terms stated here may be subject to change without notice. Business Accounts are only available to Dealer Banking Customers. FDIC insurance available to legal limits. Products offered by Toyota Financial Savings Bank. Deposits in savings accounts, money market accounts, and Certificates of Deposit (CDs) are insured up to $250,000 per depositor, per insured bank, for each account ownership category under the FDIC's general deposit insurance rules.

1. Money Market and Savings Accounts: Minimum opening deposit for a Personal Money Market and a Personal Savings Account is $500.00. Minimum opening deposit for a Business Money Market and a Business Savings Account is $2,500.00. Interest Rates and APYs on Money Market and Savings accounts may change after the account is open.

* All Account Types: Minimum balance to earn interest: $0.01. Interest Rates and APYs are accurate as of the effective date of the Deposit Rate Sheet. See our APYs, Fees, Terms and Disclosures here. Fees could reduce earnings on these accounts. APYs and other fees and terms stated here may be subject to change without notice. Business Accounts are only available to Dealer Banking Customers. FDIC insurance available to legal limits. Products offered by Toyota Financial Savings Bank. Deposits in savings accounts, money market accounts, and Certificates of Deposit (CDs) are insured up to $250,000 per depositor, per insured bank, for each account ownership category under the FDIC's general deposit insurance rules.

2. Certificates of Deposit: Minimum opening deposit for a Certificate of Deposit account is $1.00. Interest Rates and APYs for Certificates of Deposits are fixed and are guaranteed for the length of the initial term. All Certificates of Deposits may be subject to an early withdrawal penalty. All Certificates of Deposit are automatically renewable.

* All Account Types: Minimum balance to earn interest: $0.01. Interest Rates and APYs are accurate as of the effective date of the Deposit Rate Sheet. See our APYs, Fees, Terms and Disclosures here. Fees could reduce earnings on these accounts. APYs and other fees and terms stated here may be subject to change without notice. Business Accounts are only available to Dealer Banking Customers. FDIC insurance available to legal limits. Products offered by Toyota Financial Savings Bank. Deposits in savings accounts, money market accounts, and Certificates of Deposit (CDs) are insured up to $250,000 per depositor, per insured bank, for each account ownership category under the FDIC's general deposit insurance rules.

3. FDIC INSURANCE: Funds in your account(s) with us are insured by the Federal Deposit Insurance Corporation (FDIC) and backed by the full faith and credit of the United States government. Deposits in savings accounts, money market accounts, and Certificates of Deposit (CDs) are insured up to $250,000 per depositor, per insured bank, for each account ownership category under the FDIC's general deposit insurance rules. FDIC insurance available to legal limits

* All Account Types: Minimum balance to earn interest: $0.01. Interest Rates and APYs are accurate as of the Deposit Rate Sheet. See our APYs, Fees, Terms and Disclosure here. Fees could reduce earnings on these accounts. APYs and other fees and terms stated here may be subject to change without notice. Business Accounts are only available to Dealer Banking Customers. FDIC insurance available in legal limits. Products offered by Toyota Financial Savings Bank.

4. Upon completion of approved application and subject to eligibility requirements.